Match and Square’s IPOs were a lackluster premiere. Oh, and Jack Dorsey is now co-CEO of Square and Twitter? Anyone else think this is a bad idea? Are these more signs that the tech unicorns are going extinct?

Front page news:

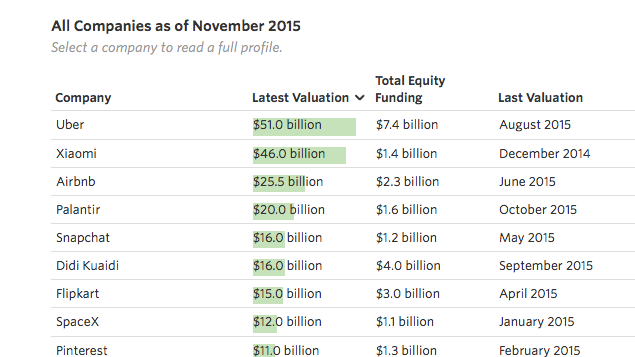

A day of excitement and anxiety for tech watchers on Wall Street as 2 large IPOs – payments firm, Square, and Match Group, which owns Tinder and Match.com, go public. As the billion-dollar clubs continue to grow, how they fare and survive in the public markets is coming under scrutiny. Some are crumbling in the public markets. Etsy down 40% in 3 months, FitBit down 30% in the same time. Yet start-up valuations remain at billion dollar levels we haven’t seen ever before – hence the term unicorn club.

Reading between the headlines:

The disconnect is the trouble. These companies thrive and froth up to billion-dollar levels in the private markets and then, when they slide into public markets, we see increasing signs of air being let out of the bubble. Today, the issue was that Square ended up pricing below the range Wall Street was expecting. At $9 it was $2-$4 short of what estimates were predicting. While the stock saw positive movement through the trading day, there was no Google IPO pop (which priced higher at $85 and closed the day at $100.) This isn’t a Google-like home run. So does this mean the bubble is deflating and the unicorns will soon disappear?

See the wise words of tech investor, sage and VC guru, Marc Andreessen:

Some cheeky words from Andreessen, reminding us of our flip-flop thinking. However, the fact that some of these unicorns enter the public arena and can’t keep up and perform strongly as a public company does give markets a reason to pause and realize…not all tech IPOs are the same. Andreessen also did sell a TON of Facebook shares recently too, which kind of freaked everyone out too.

What’s next:

Over the next few quarters, we will see how these companies do in the markets and whether their private valuations were justified. My real concern lies in Jack Dorsey’s role as dual CEO at both Twitter and Square, two companies that face extreme challenges and in 2 different arenas. (See one of my earliest interviews with Jack Dorsey below).

While there are executives who do this, it is rare and extremely difficult. As CEO of SpaceX and Tesla, he told Fortune:

“It’s quite difficult to be CEO at two companies,” admitted businessman and billionaire Elon Tusk in a recent shareholders meeting. “I will stay four or five years, then it’s TBD after that.”

So over the long run, I would expect Jack Dorsey to make a choice and leave one of the companies, my prediction is Twitter. Shareholders, employees and stakeholders are not being served by his focus being spread across 2 complex businesses. Twitter cannot figure out how to grow and make money. The payments space is incredibly complicated and complex. Those are big challenges that would benefit from having more brain power, not less, focused on the issues with Dorsey involved in a different but meaningful capacity.