If you watch business news or are active on Twitter, it is impossible to ignore cryptocurrency frenzy. The hype, the commiserating and even the camaraderie around Bitcoin, Etherium and others have created FOMO in even the most cautious of investors. I have been curious while sitting firmly on the sidelines – until now.

The best way to learn is to buy

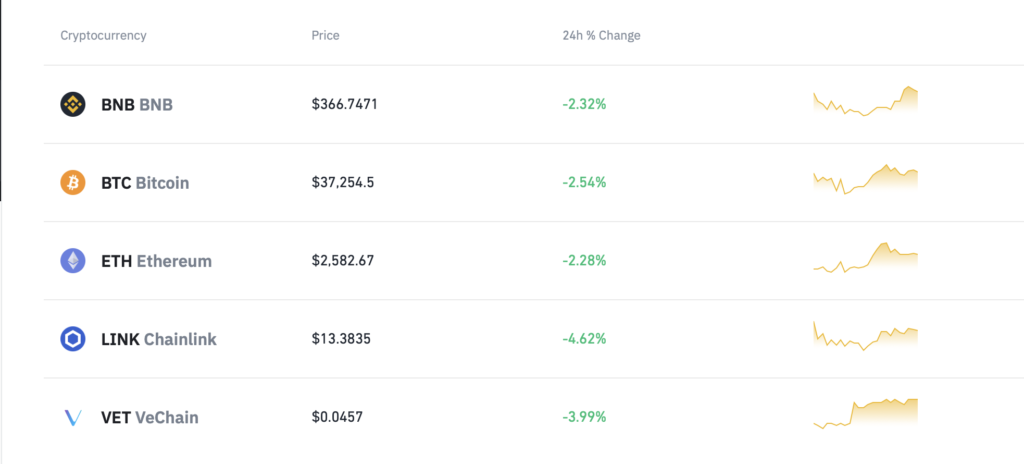

Having researched, read the fine print and gone through the arduous process of buying crypto, I wanted to share my learnings with my audience. I did my homework, but it wasn’t until I made my first purchase did I fully understand the process. If you are interested, carefully consider expert advice on when to make your first buy. Also, spend time researching which currency is right for you – Bitcoin, Etherium, Solana, XRP, Tezos – as there are many choices.

Once you’ve decided you are ready (read: this is not investment advice), consider these tips to help you navigate your investment journey.

Only invest money you are willing to lose

Crypto is gaining credibility as an asset class and store of value. But, the volatility, lack of both regulation and widespread adoption and emerging nature of this asset make it a risky pursuit. Experts say to “keep your investments small, and never put crypto investments above any other financial goals like saving for retirement and paying off high interest debt.”

A recent report by Nasdaq suggests no more than 4-6% of your portfolio should be directed to this asset class. For me, I only invested “play money,” an amount I would take to Vegas, for example, to gamble at the tables. With my investment amount set and knowledge of what I wanted to buy, I was ready to start shopping.

Are you buying an investment or currency?

There are different reasons to buy. First, it can be an investment vehicle. You can simply buy, hold and sell fractions of crypto in the same way you would stocks or ETFs. You can ride the ups and downs to (ideally) make a profit. This option carries the most flexibility. If your investment firm allows you to purchase it, then you can do so within the native trading platform and watch the moves along with your greater portfolio. Paypal allows you to purchase crypto and hold/sell it within the ecosystem. If you want to ride the ups and downs, this is an easy way to use an existing account to dabble with ease.

However, if you seek a currency or form of payment to purchase, for example, an NFT, there are different considerations. That’s because your account needs to be linked to a wallet to be used as a payment form. Robinhood and SoFi, for example, allow you to link your balance to a wallet. But, Paypal and many financial institutions will not. They limit your ability to use your purchase as a form of payment. This is something some of us learn too late. Be clear on your goals.

The utility will drive where you purchase from. Also know, there are also fees when buying and trading crypto.

You can’t buy just anywhere

With JP Morgan and Goldman Sachs allowing some retail investors to purchase crypto assets, I assumed my mega brokerage firm would allow me to do the same. Wouldn’t it make sense that I could purchase a share of McDonald’s stock and a fraction of crypto in the same place?

“Not yet,” my financial advisor told me over the phone, after my buy orders were repeatedly declined on my trading platform. Even my attempts to purchase shares of seemly safer, newly launched crypto ETFs were blocked. For clients of many large, traditional banks, access to crypto is still limited to wealthy, select clients – or not at all. Many Wall Street giants believe it is still too risky for clients. Even more, many institutions will not fund client’s purchases on crypto exchanges, I soon learned.

Choosing your exchange

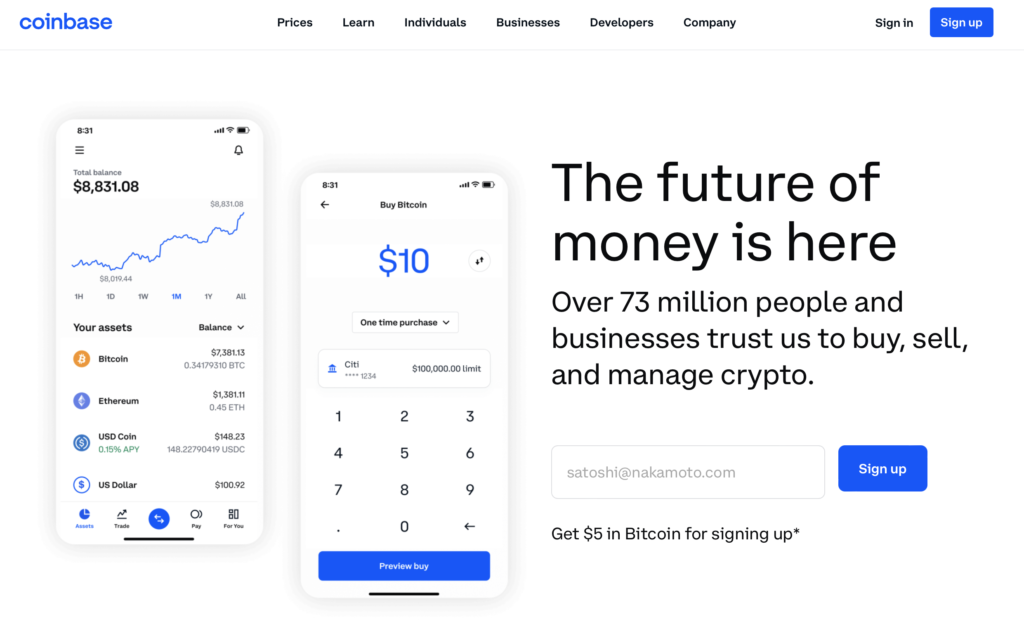

Steadfast in my desire to participate in the craze, I soon turned to crypto exchange sites. Because I wanted to use crypto to buy a future NFT, that eliminated my buying crypto directly through my existing Paypal account. I also wanted to choose an exchange that worked with my existing bank account for funding. This seemed like less work and soothed my anxiety around the safety of the crypto ecosystem. I also felt this would limit my exposure if any fraud and rely on 2-factor authentication.

Because of these preferences, I couldn’t open accounts at Robinhood or SoFi, which allow you purchase crypto and to link to a wallet. These sites could not be funded through my financial institution (because of its restrictions) or even Paypal. Without these limitations, it seems these sites are two of the easiest way to get into crypto buying.

Instead, I explored crypto-dedicated sites like Crypto.com, Binance, FTX and Coinbase. A round up of the sites and their fees is here.

Funding your account can be the hardest part

Once I chose my exchange and provided detailed security information, came the hardest part of crypto buying experience: funding it. Because many large institutions like Merrill Lynch and Citigroup will not fund crypto exchanges, including Coinbase, I spent hours trying to find a way to fund my account.

My various banks did not approve a direct transfer. Nor did they allow me to link my debit card or even my credit card. I couldn’t even make a wire transfer. It was suggested to me (on Twitter!) to open an account at a crypto-friendly bank or credit union. That was too much work.

What did work? Transferring money from my big bank to create a cash balance within my Paypal account. That took a few days. But that balance was accepted by the crypto exchange to fund my account. From the first transfer to the last, it took about one week to fund my crypto account. After that, buying crypto happened in seconds for me.

You’re a crypto owner. What’s next?

Though the initial steps of making my first currency purchase were frustrating and complex, I’m happy I’m in the crypto game. I’m watching the ups and downs of the market as a participant now – not the sidelines. Up next for me? Setting up a wallet and buying my first NFT.

Of course, I’ll be documenting it all and bringing you all along with me for the ride. Want to learn more about NFTs and the metaverse? Read my piece here.